Many people want to buy a treadmill for exercise at home. But they wonder, “Can I use my HSA money to pay for it?” This question is common. It is important to understand what HSA funds are and how they work.

What Is an HSA?

HSA means Health Savings Account. It is a special bank account for health costs. People put money into this account before taxes. This helps them save money on health expenses.

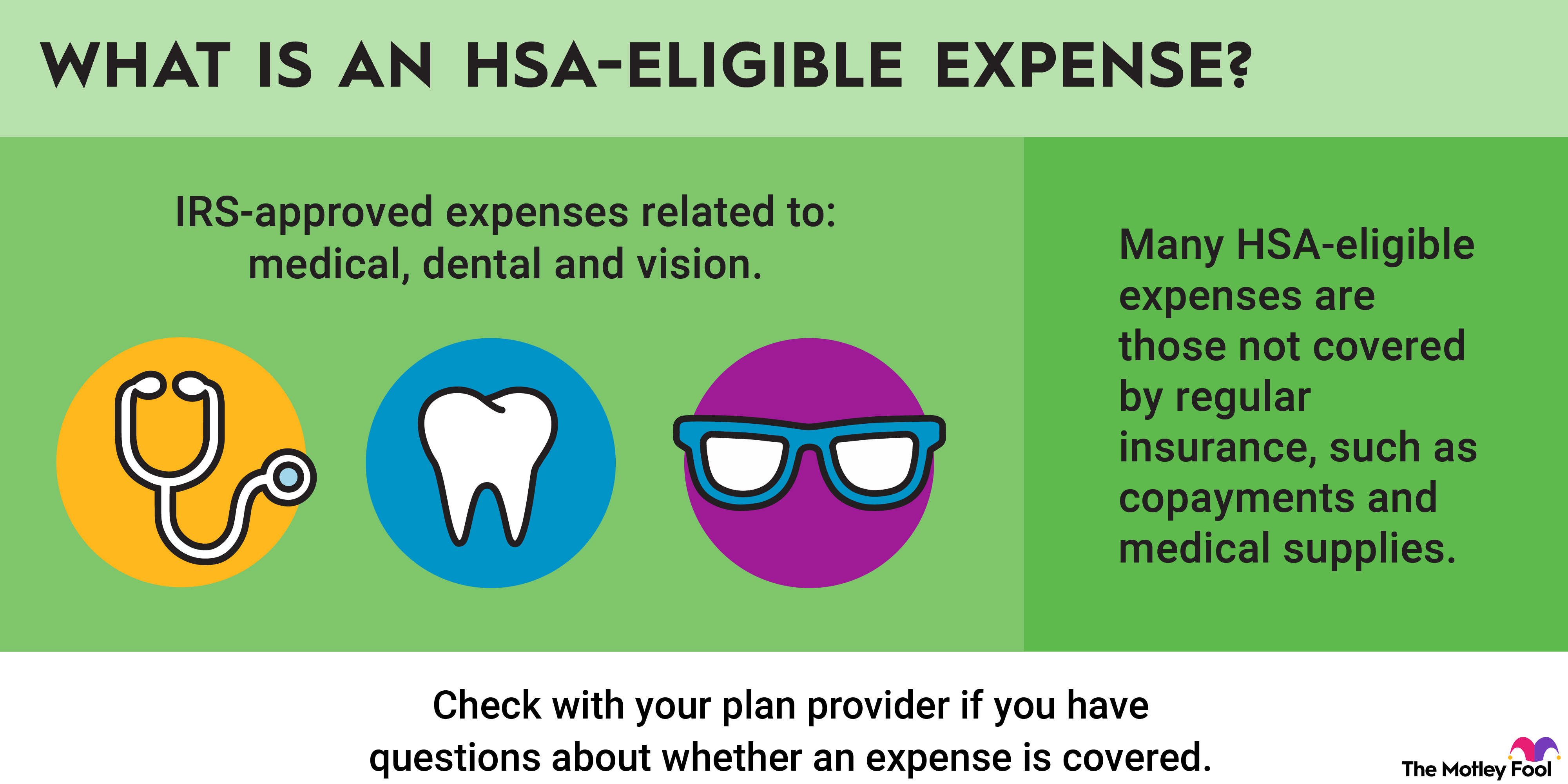

You can use HSA money to pay for many health-related things. But rules decide what you can buy.

Credit: www.nordictrack.com

What Can You Use HSA Funds For?

You can use HSA money for medical care. This includes doctor visits, medicines, and medical devices. Many items count as “qualified medical expenses.”

Examples of qualified medical expenses are:

- Doctor visits

- Prescription medicines

- Medical equipment like crutches or blood pressure monitors

- Some types of therapy

But not everything related to health is covered. Some items do not qualify.

Is a Treadmill a Qualified Medical Expense?

A treadmill is a machine for exercise. Exercise helps health. But is it a medical expense? Usually, no.

IRS rules say you can only buy items with HSA funds if they are for medical care. A treadmill is seen as exercise equipment, not medical care.

So, in most cases, you cannot use HSA money to buy a treadmill. The IRS does not consider it a medical item.

Are There Exceptions?

Yes, there are some exceptions. If a doctor gives you a letter. The letter must say the treadmill is for a medical reason.

For example, if you have a health problem. Your doctor might say you need a treadmill to help. Then, it may count as a medical expense.

In these cases, you can use HSA funds for a treadmill. But you must keep the doctor’s note. It proves your reason for buying the treadmill.

Why Would a Doctor Prescribe a Treadmill?

Some health problems need exercise. A treadmill can help with these problems. For example:

- Heart problems

- Physical therapy after injury

- Weight management under medical advice

- Improving mobility for certain conditions

If your doctor says a treadmill will help your health, ask for a written note. This helps if you want to use HSA money.

What Happens If You Use HSA Funds for a Treadmill Without Doctor’s Note?

If you buy a treadmill with HSA money without a doctor’s note, you may have problems. The IRS can ask you to pay taxes on that money. You may also pay a penalty.

It is important to keep good records. Keep receipts and doctor’s letters. This helps if you get a question from the IRS.

How to Use HSA Funds Wisely?

Use HSA money only for approved expenses. Check the list of qualified medical expenses. You can find this list on the IRS website.

If you want to buy a treadmill, first talk to your doctor. See if they can give you a letter saying it is needed for health.

Then, keep all papers and receipts. This keeps your HSA use safe from trouble.

Credit: thefitnessoutlet.com

Other Ways to Use HSA for Fitness

Even if you cannot use HSA for a treadmill, some fitness items may qualify. For example:

- Physical therapy sessions

- Home medical devices prescribed by a doctor

- Some special braces or supports

Always check if an item is qualified before buying with HSA money.

Summary Table: Buying a Treadmill With HSA Funds

| Situation | Can You Use HSA Funds? | Notes |

|---|---|---|

| Buying treadmill without doctor’s letter | No | Not a qualified medical expense |

| Buying treadmill with doctor’s prescription | Yes | Doctor must state medical necessity |

| Using HSA for other exercise equipment | Usually No | Must check if qualified expense |

Final Thoughts

Can you buy a treadmill with HSA funds? Usually, no. But sometimes yes, with a doctor’s note.

Always check rules before spending HSA money. Use the money for real medical needs.

Keeping good records helps you avoid trouble with the IRS. Talk to your doctor if you want to buy a treadmill for health reasons.

That way, you can make smart choices with your HSA funds.

Frequently Asked Questions

Can Hsa Funds Cover Treadmill Purchases?

HSA funds can cover treadmills only if prescribed by a doctor for medical reasons. Without a prescription, treadmills are usually not eligible for HSA payments.

Do I Need A Doctor’s Note To Buy A Treadmill With Hsa?

Yes, a doctor’s note or prescription is required to prove medical need. This makes the treadmill an approved medical expense.

What Qualifies A Treadmill As An Hsa Eligible Expense?

The treadmill must be prescribed to treat or prevent a medical condition. General fitness or weight loss goals don’t qualify.

Can I Use Hsa For Treadmill Maintenance Or Repairs?

HSA funds typically cannot be used for treadmill repairs or maintenance. Only the purchase cost with a valid prescription is eligible.